Nov 05, 2019 Sports betting specialist Kambi Group has forged a long-term partnership agreement with Seneca Gaming Corporation, the operator of three Class III gaming operations in Western New York, in collaboration with gaming and platform provider Bragg Gaming Group. The multi-channel deal sees Kambi install its portfolio of on-property sports wagering products inside Seneca Niagara Resort &. 289 reviews of Seneca Niagara Resort & Casino 'Staff is always friendly and fast with my orders. They have a Tim Hortons and cold stone creamery! They don't have breakfast sandwiches available all day, but they are available 5am-10am.

Today I received the following inquiry:

“[L]ooking for some info why 30% was tak[en] out of an $83 winning in poker at a NY state casino when most states tax after 5k.”

The casino in this case was the Seneca Niagara Casino, located in Niagara Falls, NY.

To evaluate the issue, we need to know whether the taxpayer is a U.S. resident. That’s because the rules for withholding and informational reporting of gambling winnings under the Internal Revenue Code depend on the residency status of the taxpayer.

It turns out this taxpayer is a resident of Canada. In general, gambling winnings paid to foreign individuals are subject to 30% withholding, assuming the income is not effectively connected with a U.S. trade or business. Proceeds from a wager placed in blackjack, baccarat, craps, roulette, or big-6 wheel, however, are not amounts subject to reporting.

Here, it seems that Seneca properly withheld thirty percent of the $83 winnings, as poker is not exempt from nonresident withholding.

Note that an applicable tax treaty between the United States and a treaty partner may reduce the amount withheld by Seneca Niagara. The United States-Canada Tax Treaty, however, offers no such relief.

Is there any other relief? Suppose the same taxpayer enters in only one other poker tournament during the year paying an $83 entry fee, and loses. Now the taxpayer has net $0 of gambling winnings for the year, yet approximately $25 was withheld on the $83 win. One shouldn’t pay $25 in U.S. tax on net zero gambling winnings. To possibly obtain a refund, the taxpayer could file a Form 1040NR to claim the winnings and losses for the year and the amount withheld.

Keep in mind that the withholding and informational rules discussed above are pursuant to federal law, not state law. Again, U.S. casinos are required to withhold 30% and issue a Form 1042-S to nonresidents unless an exception applies.

Of course, some states have their own separate informational and withholding rules for state income tax purposes. But they are not in lieu of federal law, which still must be followed, but are in addition.

The comment that “most states tax after 5k” is likely a reference to the federal rule that requires all U.S. casinos to issue a Form W-2G to U.S. residents who win more than $5,000 in a poker tournament, net of the entry fee. Note, however, whether a W-2G is actually issued has no bearing on whether the actual winnings are taxable, as all gambling winnings of U.S. residents are taxable, regardless of the amount.

Nya:wëh sgënö′

“I am thankful you are well”

If you’ve already stayed with us at Seneca Niagara Resort & Casino, we hope you had an enjoyable time!

We want to hear about your experience. If a member of our staff went out of his or her way to provide you outstanding service, please let us know! If you have a suggestion of how we can do better, we want you to tell us.

We will do everything we can to make Seneca Niagara Resort & Casino your premier destination for slots, table games, dining and entertainment.

You can reach us by mail or phone at:

Seneca Niagara Resort & Casino

310 Fourth Street

Niagara Falls, NY USA 14303

Fallsview Casino

(716) 299-1100

1-877-8-SENECA (1-877-873-6322)

To make a hotel reservation, call 1-877-8-SENECA (1-877-873-6322).

Seneca Niagara Casino Tax Forms 2018

Seneca Niagara Casino Tax Forms Ny

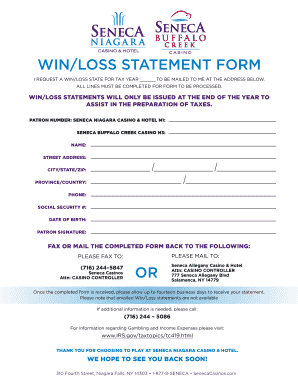

Need a Win/Loss Statement?

A Social Club by Seneca card is the first step in establishing the kind of personal relationship that you’d expect from Seneca Casinos. As a valued Social Club by Seneca member you are eligible to request a statement of your winnings or losses. Click here for more details.